National Insurance rise

From now employees will pay National Insurance contributions on earnings above 9880 a year. The national insurance rise is a significant change to our tax system but what will it mean for youSUBSCRIBE to our YouTube channel for more videos.

Firstly the national insurance rate is going up by 125 percentage points from 6 April.

. Critics have said the increase could contribute to inflation - the rate at. From April this will rise to 1325 per cent which is expected to disproportionately affect. That will take around two million workers out of direct tax altogether if they earn less than 12570 per year.

Voluntary contributions come under class 3. This means you will not pay NICs unless you earn more than 12570 up from 9880. Take for example someone earning 27000 a year.

From 6th April 2022 to 5th April 2023 National Insurance contributions will rise by 125 to fund the NHS and health social care. The tax rise comes on top of soaring energy bills and sky-high inflation which is currently at 62 but expected to rise even higher this month. The National Insurance rise is not quite all it seems.

How National Insurance is changing. Class 4 paid by self-employed. National Insurance increase from April 2022 From 6 April 2022 to 5 April 2023 National Insurance contributions will increase by 125 percentage points.

Yet this understates the rise which for most people sees contributions rise from 12 to 1325 - a hike in contributions of 104 Martin called this out in a tweet on 27 January which was soon picked up by many thousands of others. Secondary Class 1 1A and 1B paid by employers. This means rates will rise from 12 on earnings between 184 to 967 a week to 135.

The rate on earnings over this amount will also rise from 2 to 325. Class 1 paid by employees. Certain NIC rates will increase by 125 percentage points from April 2022.

Govuk had written that national insurance contributions would rise by 125 from 6 April 2022. That might sound small in percentage terms but its actually a sizable tax rise. If you are employed this will come out of your wages before you are paid and the contributions will show in your payslip.

It means that everything you earn over the tax-free threshold was being taxed at 12 and will now be taxed at 1325. How much more employees. There are concerns the increase will have a higher impact on the lower-paid.

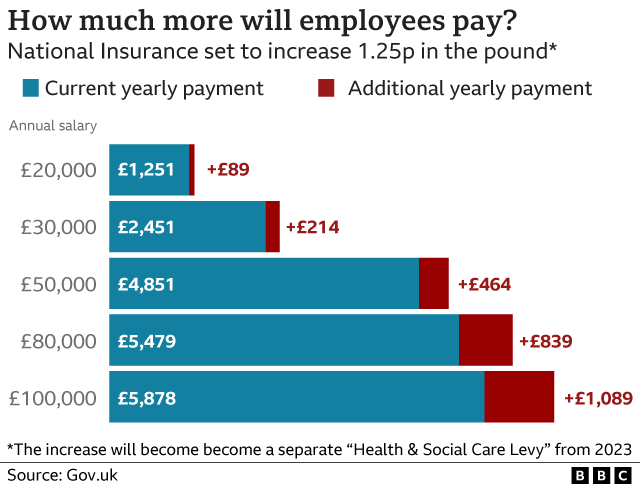

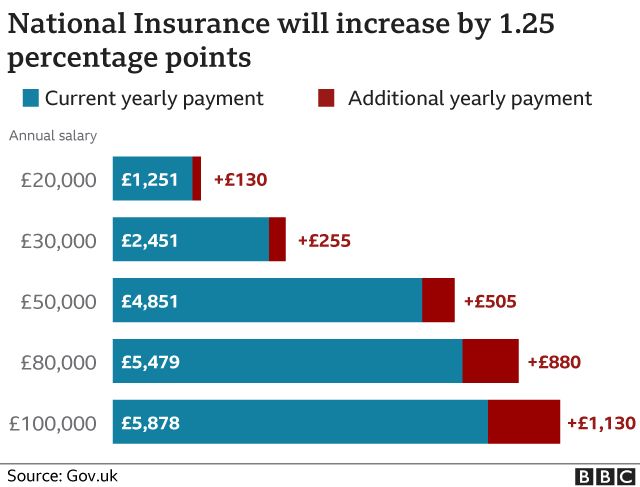

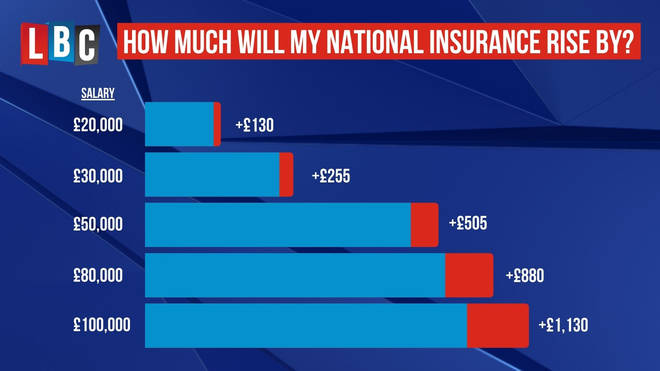

However despite the National Insurance increase. The lower earnings limit will rise by 3000 bringing it in line with the income tax threshold. The changes will see an employee on 20000 a year pay an extra 89 in tax while someone on 50000 will pay 464 more.

This will be spent on the NHS health and. The increase will apply to the following classes outlined below. National Insurance is planned to rise by 125 percentage points in April to tackle the Covid-induced NHS backlog and reform social care.

Most employees currently pay 12 of their income between 9568 and 50270 each year in national insurance and 2 of income above 50270. National Insurance payments have risen by 125 percentage points. This will rise to 105pc and 35pc in April 2022.

On Wednesday national insurance contributions will increase by 125 percentage points. The rate for voluntary. National insurance rise forces UK employers to shoulder 9bn tax burden.

From 6 April 2022 theyll pay. From April 2023 onwards the NI rate will decrease back to the 2021-22 level with a new 125 per cent health. Mon 7 Mar 2022 1730 EST Labour will spring a snap vote on cancelling the increase in national insurance contributions NICs on Tuesday warning it will cost the average private sector worker 410.

The national insurance rise means that for employees instead of paying 12 on earnings up to 50270 and 2 on anything above that youll pay. Employers pay 138pc but this will also rise to 1505pc in April. Currently employees pay 12 per cent national insurance on their earnings between 9568 and 50268.

National insurance contributions NIC will rise for millions of workers today as the Government introduces its manifest-breaking tax hike. NI starting thresholds will rise by 3000 from July 2022 aligning the income tax and NI thresholds in a tax cut worth over 6 billion according to the. Rishi Sunak announced that the threshold at which you start paying National Insurance will change from July.

But from July national insurance will only start to be charged on earnings over 12570 because chancellor Rishi Sunak announced a 3000 rise in the NI threshold in last months spring statement. This is because workers pay 12 National Insurance on earnings between 9564 9880 from April and 50268. The national insurance rate above this primary threshold will go up from 12 to 1325 while national insurance charged on earnings over 50270 will rise from 2 to 35.

Prime Minister Boris Johnson has defended the increase. As the rates are a percentage of your. Bosses say 125-point rise heaps pressure on firms already enduring soaring costs linked to Covid and Brexit.

From July it will be paid on earnings above.

National Insurance Rise Will Squeeze Budgets Cbi Bbc News

Business Bosses Warn New Tax Could Hit Jobs Bbc News

National Insurance Rise How Much More Will You Need To Pay Lbc

National Insurance Rise What Social Care Reform Means For Your Income Huffpost Uk Life

National Insurance Rise Taxpayers To Pay Hundreds Of Pounds More As Johnson And Sunak Confirm Hike Will Go Ahead

Post a Comment

Post a Comment